- 28/03/2024

- Media Releases

LIBERTY announces UK strategic steel plan after signing new creditor framework agreement

LIBERTY today announces the strategic plan for its UK steel assets after signing a new framework agreement (“the framework”) with its major creditors.

The new framework comes after LIBERTY has achieved major milestones in raising new capital including a successful US$350m bond issue by its InfraBuild business, Australia’s leading recycling and low carbon steel producer, through Jefferies LLC and a $350m Asset-Backed Term Loan through BlackRock and Silver Point Finance.

Execution of the framework agreement will allow LIBERTY to build on improvements it has made across the group since the collapse of Greensill Capital and to consolidate its UK steel businesses under a new entity with a simpler structure, a strong balance sheet and greater access to third party finance and investment.

New UK Corporate Structure

Upon final settlement execution, LIBERTY will aim to consolidate its steel businesses under a new entity and corporate structure. It is proposed that the existing companies will transfer their assets and employees to the new company, subject to final structuring and agreements. Employees will carry over existing terms and conditions, with continuity of employment preserved. There will be no impact on operations, suppliers or customers.

Business Update

An operational restructuring plan implemented last year focused LIBERTY’s steel businesses in the UK on supplying strategic aerospace, defence and energy customers, strengthening financial performance significantly. This improved operational and commercial viability has enabled development of a comprehensive plan that aims to take LIBERTY’s electric arc furnace (EAF) melting capacity at Rotherham to 2 million tonnes per annum quickly and cost effectively, and with significantly lower emissions compared with coal-based blast furnaces.

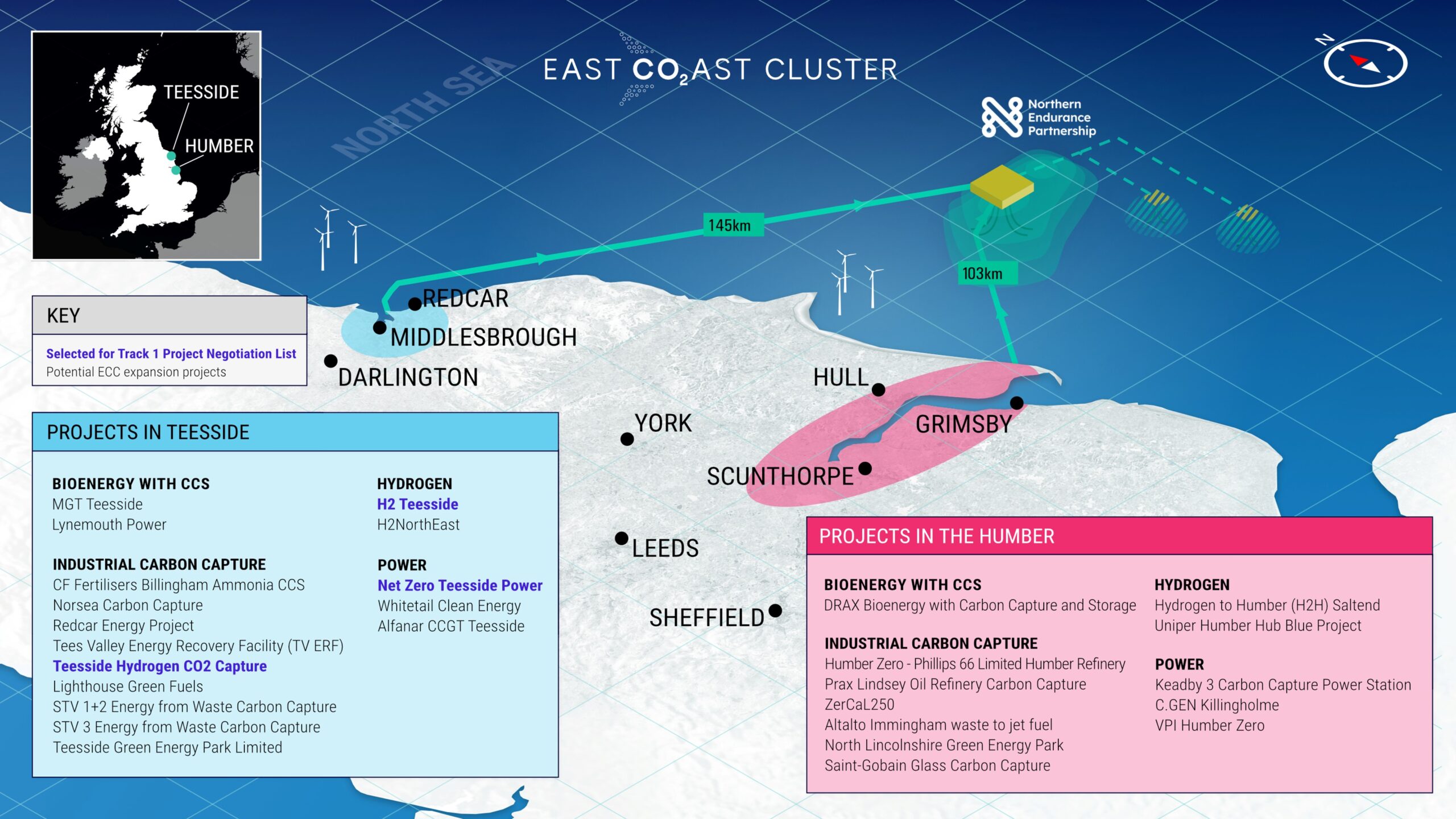

LIBERTY’s UK steel assets, including the country’s largest electric arc furnaces in Rotherham and associated downstream mills around the country, benefit from product diversity with significant capacity in both long and flat products, scalable grid connections, scrap metal processing and proximity to future hydrogen trunkline delivery and planned carbon capture and storage (CCS) networks. The Stocksbridge plant has few peers in supplying key components to the aerospace and defence industries. The Hartlepool pipes division was recently selected for a major contract to supply CCS pipelines to the key UK energy infrastructure development by Northern Endurance Partnership and Net Zero Teesside Power and is one of a handful of facilities globally that can produce hydrogen grade pipe. The Dalzell plant in Scotland supplies specialist heavy steel plate to the energy and infrastructure sectors.

LIBERTY Steel’s UK operations have since October 2021 been supported by £210 million loss funding by LIBERTY’s shareholder to maintain employment, operations, and growth potential.

Jeffrey Kabel, LIBERTY’s Chief Transformation Officer, said:

“Following our successful capital raising in 2023 we are now in a position to execute this new updated creditor framework. The completion of the deal will enable our businesses to build on the operational, commercial and governance improvements we’ve made across the group over the past three years.

In the UK our focus on specialised steel products serving strategic supply chains in aerospace, defence and energy, has allowed us to stabilise operations and significantly improve business performance. Our restructuring agreement now paves the way for a new company structure that will allow us to significantly increase our lower carbon emissions steel production in Rotherham feeding our network of downstream mills around the country.

While we still operate in challenging market conditions, these changes will put our UK businesses in a position to reclaim its leading position as champion of green steel and sustainable industry. Upon completion of the deal, this will enable us to raise new capital, rebuild stakeholder confidence, and ultimately reach our full potential.

With our existing strengths in sustainable UK steel and aluminium production, and our magnetite mining resources in Australia to supply the production of DRI, we are prepared to play a leading role in the UK’s Net Zero strategy, and the development of a clean and thriving UK steel sector.”

ENDS

Further information from:

| David Ollier

Global Head of Communications |

+44 7596 297773 | David.Ollier@gfgalliance.com |

| Andrew Mitchell

Head of Communications – UK

|

+44 7516 029522 | Andrew.Mitchell@gfgalliance.com |

Note to the editors:

GFG Alliance is a collection of global businesses and investments owned by Sanjeev Gupta and his family. The Alliance is structured into three core industrial pillars; LIBERTY Steel Group, ALVANCE Aluminium Group and SIMEC Energy Group, independent of each other yet united through shared values and a purpose to create a sustainable future for industry and society. GFG Alliance employs 35,000 people, across 10 countries and has revenues of USD $20bn. GFG Alliance is a leader in sustainable industry with a mission to become Carbon Neutral by 2030 (CN30).

www.gfgalliance.com

Latest News

View All Media Releases

Media Releases

Tees Mayor visit highlights rich energy pipeline potential at LIBERTY Pipes Hartlepool

Tees Valley Mayor Ben Houchen has highlighted the rich potential for LIBERTY Steel’s Hartlepool operations to lead the UK energy...

View Media Releases

Media Releases

LIBERTY appoints Thomas Gangl as CEO of its European business

LIBERTY Steel Group (“LIBERTY”) has appointed international sustainability leader Thomas Gangl as the Chief Executive Officer of its European business,...

View Media Releases

Media Releases

LIBERTY announces UK strategic steel plan after signing new creditor framework agreement

LIBERTY today announces the strategic plan for its UK steel assets after signing a new framework agreement (“the framework”) with its major creditors. The new framework comes after...

View Media Releases

Media Releases

LIBERTY Steel selected for major UK carbon capture pipeline contract

LIBERTY Steel today announces that its Hartlepool pipes division has been selected for a major contract to supply pipelines to...

View