- 16/01/2023

- News

UK steel sector – survival or renaissance?

Following years of struggle against an uncompetitive cost base, the UK steel industry is in crisis, requiring urgent restructuring to ensure its survival. However, as Jeff Kabel of LIBERTY Steel observes, there are also grounds for belief in resurrection. But this will demand revolution not merely evolution.

Wherever you look in the world, making steel is difficult but nowhere is it more demanding than in the UK.

The lasting impact of the Covid-pandemic, broken supply chains, and of course the fire breathing dragon of inflation are all now causing havoc. But the UK has had deeper problems known for years and for the most part ignored.

Management consultants call these problems: “structural challenges” which in plain English means that our operating and trading environment is less competitive than in Europe, Turkey, US, India, and China.

In 2007 the UK steel industry produced 14 million tonnes per year, and nearly all of it was part of the same group, Corus – former British Steel – headquartered in London.

Fast forward 16 years and output has shrunk by nearly 50% to 8 million tonnes, with the vast majority of the industry in foreign ownership with the exception of British owned LIBERTY Steel, and Sheffield Forgemasters, a nationalised producer.

The issues are as well-known as they are timeless, endless reports have highlighted the problems, with energy costs the consistent thread. Prices in the UK for steel makers stubbornly remain between 40% and 60% higher than our competitors in Europe.

No surprise then that the UK has been a net steel importer in all but five years since 2005, with imports massively outnumbering exports in every year since 2015. These are clear signs of an industry on life support.

Many UK steel producers, LIBERTY included, have been funding losses during the past decade to maintain operations and employment. In the past two years alone, Liberty has invested £200m to keep the plants ticking over and workers livelihoods protected. Whilst this may be noble it has massively constrained our ability to invest in the future.

All this has left the industry – and I’m sure Government too – soul-searching about its future.

We at LIBERTY have had to face up to these challenges and reduce commoditised production that is currently unviable, focusing primarily on the very high-end, specialist products we produce at Rotherham and Stocksbridge.

A complete focus on specialist products may sound like a realistic formula for the future, but recent history tells us that commodity products can shoot up the value chain if supply suddenly runs short. Besides, we need the economies of scale that commoditised products bring to support the viability of producing specialist products and to fund our upcoming transition to green steel.

Optimism may not be enough, but it’s a start

So where do we go from here? We are owned by Sanjeev Gupta, an eternal optimist, especially when considering underperforming assets. So let me lay out why we’re not giving up.

The UK has the assets. LIBERTY runs electric arc furnaces at Rotherham that recycle scrap steel and emit just a tenth of the emissions compared to blast furnace operations. These units are scalable and could, indeed should, be the foundation for green steel production in our domestic market. To lose them would make a mockery of the UK’s net zero ambitions.

We also have the supply and demand right here at home. We have an ample and growing supply of scrap steel for our furnaces. On the demand side, a UK Government study projects steel requirements to climb from 9.5 million tonnes in 2017 to 11 million tonnes by 2030 – a £4bn a year opportunity to UK producers. But only if they can operate competitively.

Finally, we have a highly trained workforce, although there is a word of warning here, skilled technicians are not going to wait around for the sector to sort itself out.

A generation ago the UK had a thriving nuclear industry founded on a technical skills base that was the envy of the world. A bonanza of cheap oil and gas – including supplies from Russia – meant we neglected that industry and lost the hard-won skills that underpinned it. We cannot make the same mistake again.

That’s why LIBERTY is working hard to retain, redeploy and reskill our employees affected by competitiveness issues through our Workforce Solutions programme. This will help ensure that talent and skills are honed and remain available for better days ahead.

Reasons to be cheerful

So are there reasons to be cheerful? Yes, because despite our challenges many of the fundamentals for success are already here and waiting.

For years our football fans complained that we had the talent and abilities in place, but we weren’t reaching our potential. The way the England football teams (especially the Lionesses) have rebuilt their fortunes at international competitions, shows the power of a coherent long-term strategy and determination to nurture talent. So, too, for the UK steel industry.

Neither the industry nor government can expect to continue to do the same old things and get different results this time around. That won’t make the industry internationally competitive, let alone world beaters.

But is being world-class a realistic aim for the UK steel sector? I believe it can be, but we need fundamental reform in energy and a long-term partnership between the industry and government to nurture our skills base, attract youth, develop our assets and forge a viable path to a sustainable future.

The steel industry cannot afford more short-term resolutions. It needs a revolution, but it cannot do this alone.

Source – Excerpt from Daily Mirror Website

Latest News

View All Media Releases

Media Releases

LIBERTY appoints Thomas Gangl as CEO of its European business

LIBERTY Steel Group (“LIBERTY”) has appointed international sustainability leader Thomas Gangl as the Chief Executive Officer of its European business,...

View Media Releases

Media Releases

LIBERTY announces UK strategic steel plan after signing new creditor framework agreement

LIBERTY today announces the strategic plan for its UK steel assets after signing a new framework agreement (“the framework”) with its major creditors. The new framework comes after...

View Media Releases

Media Releases

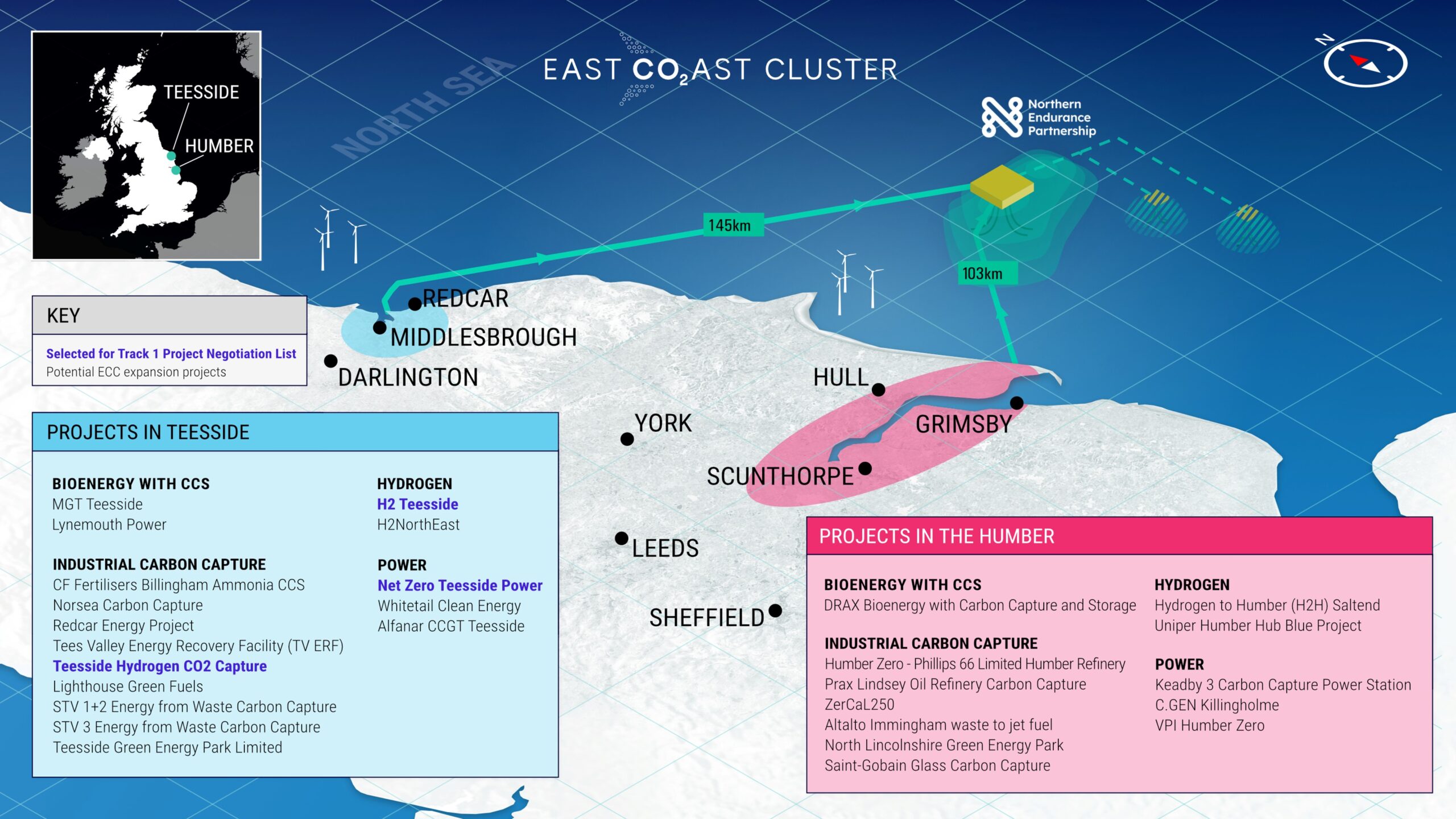

LIBERTY Steel selected for major UK carbon capture pipeline contract

LIBERTY Steel today announces that its Hartlepool pipes division has been selected for a major contract to supply pipelines to...

View Media Releases

Media Releases

GFG Alliance Signs Landmark Deals In Whyalla

Agreement on hydrogen and memorandum of understanding with Santos for gas Landmark Hydrogen Offtake agreement with South Australian Government MOU...

View