- 07/03/2018

- Media Releases

Liberty House confirmed as preferred H1 bidder for Amtek Auto India

Liberty House, part of Sanjeev Gupta’s global industrial group GFG Alliance, is set to make a dramatic entry into India after being chosen as preferred H1 bidder for Amtek Auto Pvt Ltd assets which include 35 automotive component plants across India, Japan, Thailand and Spain, employing some 6,000 people.

This high-profile investment by GFG in the Indian automotive sector will follow its success in recent years in rescuing and reviving dozens of major industrial businesses in Australia and UK, where the Group is now the largest privately-owned industrial employer.

The announcement of Liberty as the successful preferred bidder was made in the committee of creditors meeting held on 6 Mar 2018 and confirmed by the Resolution Professional on 7 Mar 2018. This follows the corporate insolvency resolution process (CIRP) of Amtek Auto which began on 24 July 2017. Amtek Auto is one of publicised 12 large insolvency cases which the key lenders took to insolvency resolution process under NCLT (National Company Law Tribunal) in India.

Amtek is one of the largest integrated auto component manufacturers in India with operations across forging, iron and aluminium casting, machining and sub-assemblies.

Its sites, which are spread throughout India’s automotive manufacturing heartlands, such as Delhi, NCR, Pune, Chennai, Bhopal and Baddi, supply precision engineered components to most large vehicle makers worldwide, including Maruti Suzuki, Tata Motors, Hero Motorcycles, Honda, Cummins, Caterpillar, JCB, Ford, Renault Nissan, Escorts, Eicher, John Deere, ITL and numerous others.

Steel and aluminium parts made by Amtek include connecting rods, crankshafts, flywheels, engine blocks, cylinder heads and various engine housing and drive train components.

Following a successful acquisition of Amtek’s operations, GFG intends to apply its GREENMETAL vision in India and develop a full end-to-end enterprise ranging from renewable energy generation and metal-making right through to finished engineering products. As part of this integrated strategy, the group is continuing to pursue other assets in India, some of which are currently in the NCLT process.

Commenting on today’s announcement, Sanjeev Gupta, GFG Executive Chairman said: “This is a very proud moment for GFG and for my family. We are very excited about this opportunity to restore a great Indian business to its rightful position and add a major new asset portfolio to our international network. This business will be the cornerstone of our strategy to bring GREENMETAL to India and expand our footprint in the automotive sector worldwide. We look forward to working closely with the high calibre customer base Amtek Auto enjoys. We are very pleased to be able to secure the jobs of 6,000 workers and welcome them to the global GFG family.”

Liberty has an impressive track record of turning around industrial assets. Its vision for Amtek will start with securing customer and employee confidence, and then look to expand production rapidly. It’s wide-ranging development plan will complement its existing automotive strategy in the UK whilst sharing many common customers.

Dr Douglas Dawson, Chief Executive of Liberty Industries Group, who lead the bid said “India is one of the most promising markets in auto and we are well poised to bring our expertise and impeccable track record in this sector from the UK to India, focusing on rapid innovation and growth.

Liberty team will now aim to meet with all the key customers and employees to thank them for their support to the business in these difficult times and ask them to partner in Liberty’s vision of achieving transformational turnaround. ”

Indian Business Development Director Rajiv Bajaj, added: “Liberty’s team is grateful to RP Dinkar Venkatasubramanian, RPs advisors, Key Lenders Group and Committee of Creditors for their hard work in this complex transaction journey. We look forward to working closely with them over the coming period to take this resolution plan to its completion and National Company Law Tribunal (NCLT) approval.”

Latest News

View All Media Releases

Media Releases

LIBERTY appoints Thomas Gangl as CEO of its European business

LIBERTY Steel Group (“LIBERTY”) has appointed international sustainability leader Thomas Gangl as the Chief Executive Officer of its European business,...

View Media Releases

Media Releases

LIBERTY announces UK strategic steel plan after signing new creditor framework agreement

LIBERTY today announces the strategic plan for its UK steel assets after signing a new framework agreement (“the framework”) with its major creditors. The new framework comes after...

View Media Releases

Media Releases

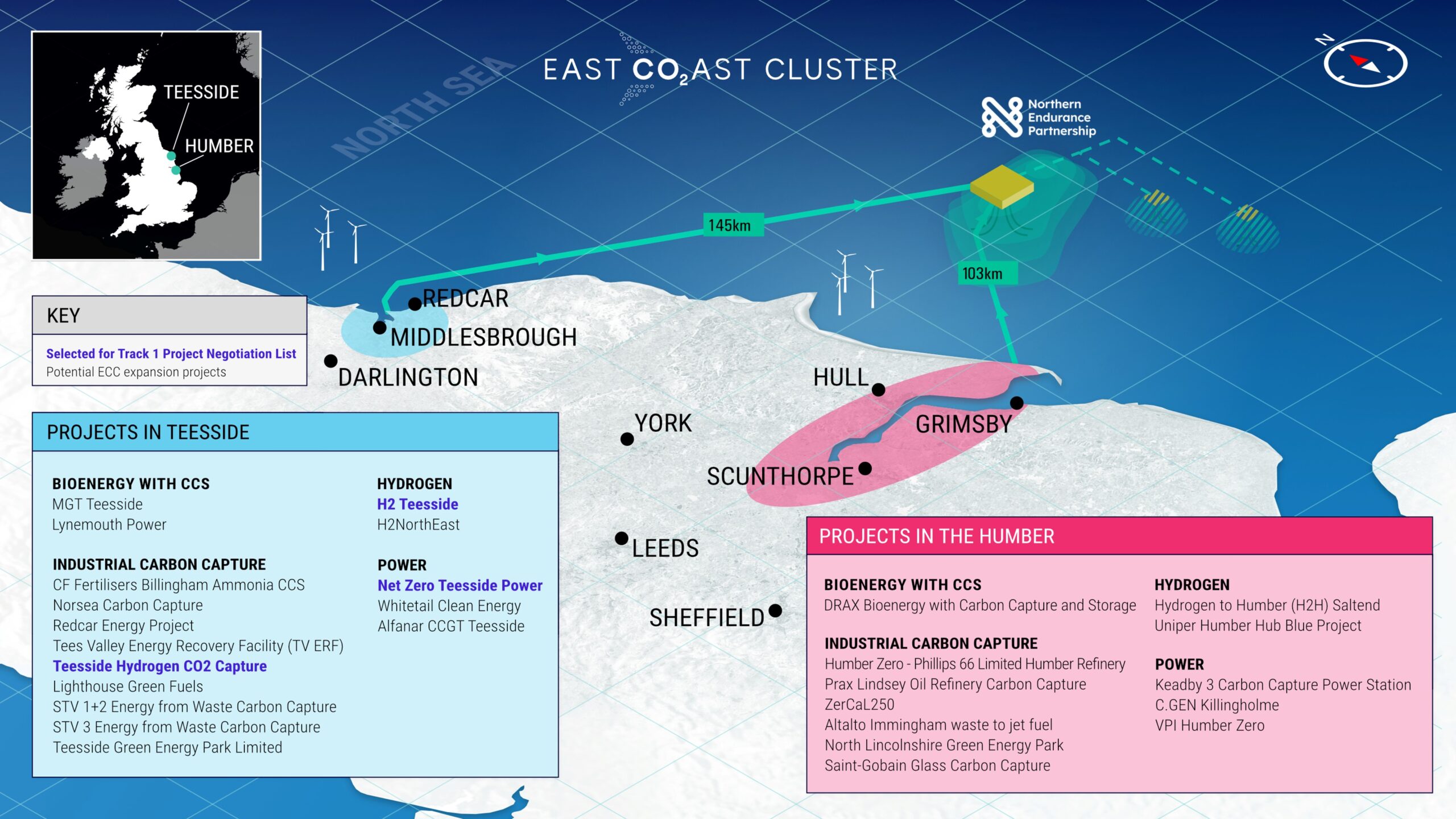

LIBERTY Steel selected for major UK carbon capture pipeline contract

LIBERTY Steel today announces that its Hartlepool pipes division has been selected for a major contract to supply pipelines to...

View Media Releases

Media Releases

GFG Alliance Signs Landmark Deals In Whyalla

Agreement on hydrogen and memorandum of understanding with Santos for gas Landmark Hydrogen Offtake agreement with South Australian Government MOU...

View