- 07/03/2022

- Media Releases

GFG Alliance issues update on restructuring and refinancing progress

GFG Alliance issues update on restructuring and refinancing progress

- Significant progress with creditors including withdrawal of petitions by U.K. HMRC

- Further funding injected into LIBERTY Steel UK to secure continued operations

- Continued progress to restructure the Group to focus on its core businesses

- Strong international steel and aluminium markets have supported robust performance

LIBERTY Steel Group’s Restructuring and Transformation Committee (RTC) today reports on the continuing developments across the Group and the sustained progress achieved to date.

Jeffrey Kabel, Chief Transformation Officer, said: “We’re pleased to report good further progress in our negotiations with creditors including U.K’s HMRC. We are committed to repaying all creditors and this is an important step in enabling us to restructure and achieve long-term refinancing.

Our core international businesses have continued to generate strong returns and achieve record production levels despite the sky-high energy costs facing energy-intensive industries across the U.K and Europe. We will continue to progress our efforts to refocus and refinance our operations for the long-term.”

Actions taken

UK

• Following positive discussions with HMRC winding up petitions have been withdrawn. In parallel, constructive discussions continue with existing creditors to repay liabilities and with new lenders over longer term refinancing of the business.

• Following the £50m injection of shareholder funding to restart operations at LIBERTY Steel UK (LSUK) in October, a further significant injection of shareholder capital has enabled renewed steel making across LSUK’s High Value Manufacturing, Narrow Strip, Engineering Bar and Merchant Bar operations. The campaigns, which will extend into March and April, will enable LSUK to serve customers and maintain market position.

• Following the announcement in May 2021 that GFG Alliance would be divesting LIBERTY Pressing Solutions Coventry (LPSC) the Group has actively been seeking potential buyers for the business. LPSC has continued to fulfil customer orders through this period, during which operations were funded through shareholder capital. The structural long-term downturn in the UK automotive market has meant that it has not been possible to find a buyer for LPSC, and as a result a formal consultation opened on March 7.

Australia

• The South Australian government has announced funding guidelines to co-finance operational efficiency projects at LIBERTY Primary Metals Australia’s (LPMA) integrated steelworks at Whyalla. It is the first step in releasing a AUS$ 50 million grant that will fund approved projects to improve Whyalla’s productivity and efficiency, to be matched on a “dollar for dollar” basis by LPMA. LPMA is working to advance strategic upgrade project proposals that qualify for government funding. The proposed grant is in addition to significant investment LPMA has already made in plant and equipment at Whyalla where an operational efficiency drive, continuous improvement initiatives and favourable market conditions have improved performance.

Regional updates

Australia

• Since the October 2021 announcement of a debt restructuring for LPMA, the integrated operations have continued to demonstrate strong performance, despite a surge in energy prices. This included a threefold increase of coal washed production and an 82% increase in sales at Tahmoor; a 12% increase in iron ore sales to 2079kt; a 17% increase in steel production at Whyalla and an 18% rise in alloy sales at LIBERTY Bell Bay. This week the Australian Government awarded a $A292million rail contract to the Whyalla Steelworks to supply 147,000 tonnes of rail to complete the Inland Rail project. InfraBuild has recorded continued improvement across all financial metrics in its H1 FY22 results and its best half year safety performance on record. Compared to H1 FY21, InfraBuild’s net revenue is up 41% to $A2.94B, with EBITDA up 109% to $A314M. InfraBuild posted a record Total Recordable Injury Frequency Rate (TRIFR) and Days Away, Restricted, or Transferred (DART) improvements for the period between July and December. In the last quarter, TRIFR was 32% better and DART 51% better than the corresponding period.

Europe

• LIBERTY Ostrava in the Czech Republic has started an extensive two year programme of modifications to its Steckel hot strip mill, costing around EUR 40 million. This will reinforce reliability and product quality, while increasing capacity utilisation to more than 1 million tonnes of flat products a year. Ostrava’s tube plant also expects to hire more than one hundred new skilled workers this year to support its drive to increase the production of seamless pipes aimed at the US oil drilling and transport markets.

• LIBERTY Galati in Romania has invested EUR 5.5 million in strengthening its Hot Rolled Coils production line to increase productivity of the mill and improve its environmental performance.

• LIBERTY Częstochowa, Poland’s only producer of low-carbon GREENSTEEL plate, has started the renovation of its two cutting lines, crucial for the successful realisation of its new “55-65-85” production strategy which initially aims to achieve the shipment of 55,000 tons of steel plate per month.

• LIBERTY Magona, Italy’s leader in galvanized and pre-painted flat rolled coils production, is planning to achieve a capacity increase of more than 20% this year. The expansion is expected to come from the addition of new capacity for painting production and a new range of galvanized and pre-painted products, supported by enhanced customer service and broader international sales network. LIBERTY Skopje in North Macedonia is also planning to increase its production to around 20,000 tonnes a month, up by 65% through operational and planning efficiencies.

United Kingdom

• Steelmaking at Rotherham and Stocksbridge has continued over the first quarter of the year following the injection of shareholder funding that enabled the restart of operations in October. A steelmaking campaign in February met planned production targets, and another has been underway during early March. Planning is advancing well for further campaigns.

• The Aluminium Stewardship Initiative has awarded ALVANCE British Aluminium’s Lochaber smelter an ASI Performance Standard certification, considered to be the gold standard for sustainable production in the industry.

United States

• LIBERTY Steel USA has successfully restarted production at its rod mill in Georgetown, South Carolina, which was closed during the Covid-19 Pandemic. 65 employees have now been able to return back to work. LIBERTY Steel USA has also implemented efficiencies such as utility cost savings, rental equipment return and contractor reductions to improve its profitability and develop a sustainable long-term plan for the plant.

• LIBERTY Steel & Wire has restarted production at its wire rod mill in Peoria, Illinois, following installation and testing of a new transformer for its electric arc furnace. The Peoria mill is the largest single location rod mill in the US.

Outlook

In response to the progress achieved by the RTC, Sanjeev Gupta, Executive Chairman of GFG Alliance, commented:

“With refinancing initiatives well underway and our businesses performing well, this will be a formative year for our organisation as we work through our transformation plan. As our restructuring and refinancing programmes continue to progress positively we are also making operational improvements to further enhance the performance of our core businesses against a backdrop of robust demand for our products.”

| Andrew Mitchell Head of Communications – UK GFG Alliance |

+44 7516 029522 | andrew.mitchell@gfgalliance.com |

| Patrick Toyne-Sewell

Head of Communications – Europe |

+44 7767 498195 | patrick.toyne-sewell@gfgalliance.com |

Latest News

View All Media Releases

Media Releases

LIBERTY appoints Thomas Gangl as CEO of its European business

LIBERTY Steel Group (“LIBERTY”) has appointed international sustainability leader Thomas Gangl as the Chief Executive Officer of its European business,...

View Media Releases

Media Releases

LIBERTY announces UK strategic steel plan after signing new creditor framework agreement

LIBERTY today announces the strategic plan for its UK steel assets after signing a new framework agreement (“the framework”) with its major creditors. The new framework comes after...

View Media Releases

Media Releases

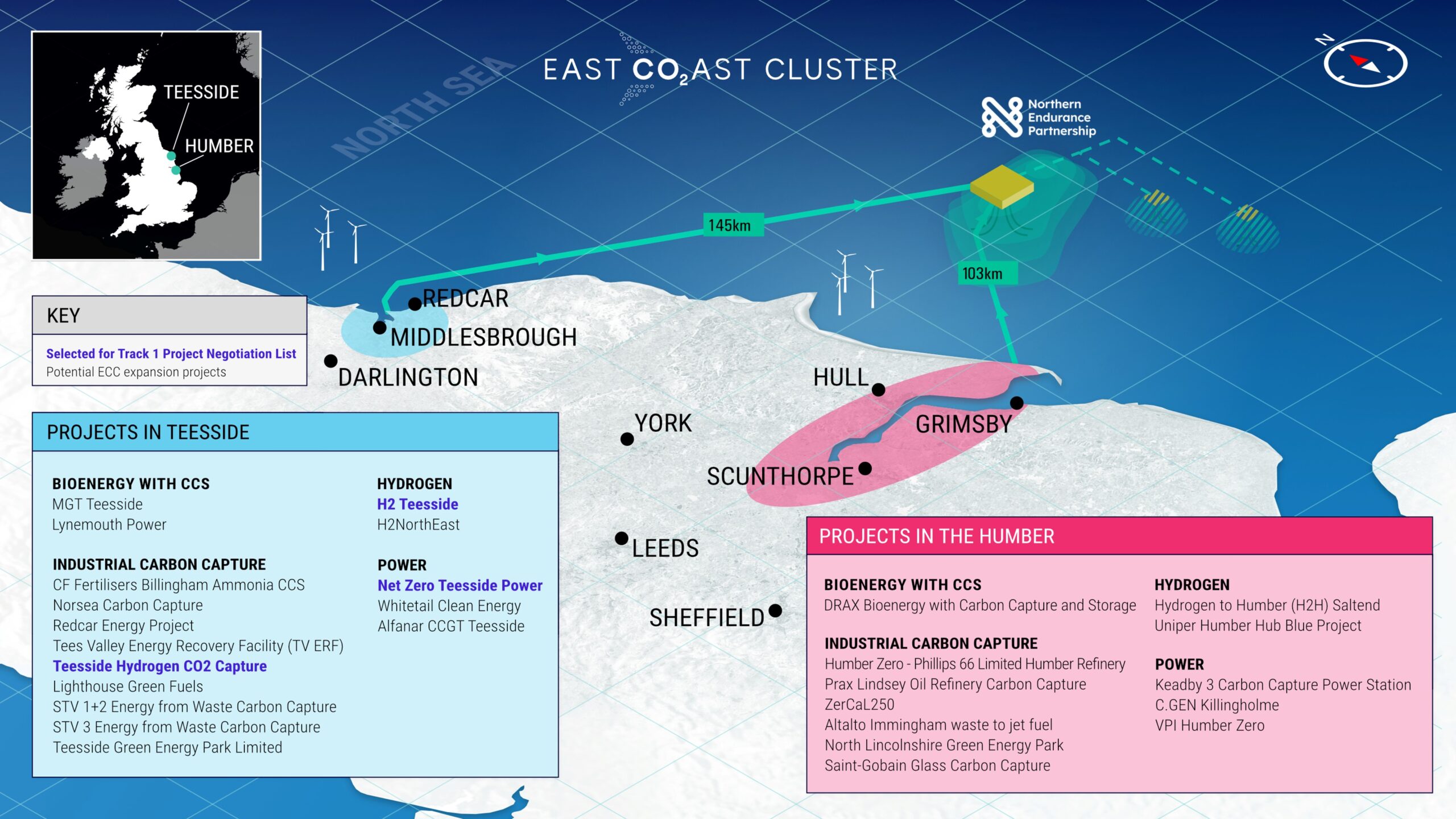

LIBERTY Steel selected for major UK carbon capture pipeline contract

LIBERTY Steel today announces that its Hartlepool pipes division has been selected for a major contract to supply pipelines to...

View Media Releases

Media Releases

GFG Alliance Signs Landmark Deals In Whyalla

Agreement on hydrogen and memorandum of understanding with Santos for gas Landmark Hydrogen Offtake agreement with South Australian Government MOU...

View